You need to ensure that you are seeking the right type of capital for your impact business in order to successfully close on your fundraising effort. The problem is that most Startup or Early-Stage Founders or CEOs looking to get funded often knock at the wrong door. They are so busy with the struggle to get enough capital that they fail to develop and implement a funding strategy that will set their business up for success.

One of our clients and startup founder, Samantha, had the foundations of a sound business idea in place, but could not get her funding off the ground. She came to us with the challenge of how to go about funding her vision for an online relationship platform.

We worked with Samantha and found that she had a great network of contacts in the venture capital space. The problem was, she did not have a strategy to identify investor prospects appropriate to the current stage of her business. After working with us she realized that she was seeking the wrong type of capital from the wrong prospects. She learned that a startup venture requires startup capital, not early-stage or growth capital. That explained the responses she received consistently: “you’re early”, “this is too early for our group”, “circle back when you’ve crossed $1MM in revenues”.

Once Samantha learned to position herself and company more appropriately and implement an impact capital strategy, she was able to raise $250,000 in startup capital to advance her business to the next stage.

We want to help you avoid that same mistake and show you 3 very important factors to determine the type of capital and investors you want to align with:

- the stage of your business

- the typical investment targets by stage

- the types of capital for the stage you are in as an impact founder or CEO

As a Startup or Early-Stage Founder or CEO looking to get funding, you absolutely need to do the following:

- Identify the stage of your business

- Evaluate how much personal equity you can invest

- Align your business model and business stage with appropriate investors and capital sources in order to begin planning your capital campaign from the right perspective

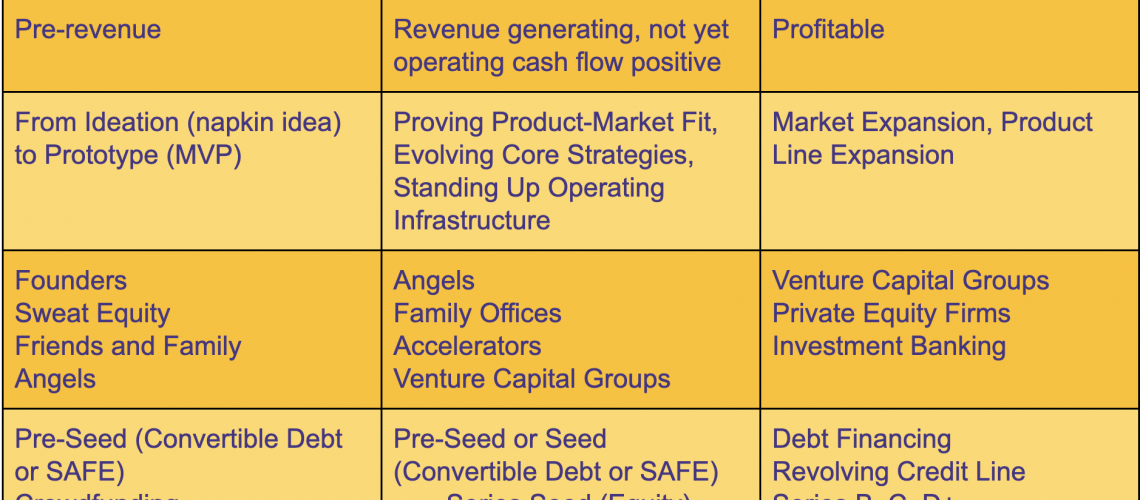

At The Change Agent Hub, we like to break down the business stages into three simple-to-understand stages: Startup, Early-stage, and Growth. A Startup is pre-revenue, an Early-Stage company is revenue generating (but not yet operating cash flow positive), and a Growth company is profitable, but opportunities remain that require additional outside capital.

At the Startup phase, you’re at what we like to call a 100% burn. So you’re completely reliant upon infusions of capital. Moving into Early-Stage, you’re less than a 100% burn.

Now what does burn stand for, you may ask? Burn is the negative cash flow that you’re in at the bottom line. You know how much it costs to run your business without revenue, or how much it costs even though you are generating revenue but not covering all your costs. So that’s your burn. In the Early-Stage company you’re less than 100% burn and as a Growth stage business, you have no burn. Even if you have no burn you’re possibly missing out on expansion opportunities because you don’t have enough working capital to take advantage of them.

The typical types of stage appropriate investors are: .

For Startup:

- Sweat Equity

- Friends and Family

- Angel Investors

For Early Stage:

- Angel Investment Groups

- Family Offices

- Accelerators

- Venture Capital Groups

For Growth Stage:

- Venture Capital Groups

- Private Equity Firms

Now, Investment Banking is a special segment of banking operations that help individuals, businesses, and governments raise capital and provide financial consultancy services. They act as intermediaries between securities issuers and investors, and are often engaged by companies that desire to go public. If this is your end game strategy, then Investment Banking partners may be on your radar.

Here are the types of capital you receive depending on your business stage:

Startups:

- Convertible Debt

- SAFE (Simple Agreement for Future Equity)

- Crowdfunding

Early Stage Business:

- Pre-Seed or Seed (Convertible Note or SAFE)

- Initial Equity Round (Series Seed)

- Series A (when approaching cash flow positive)

Growth Stage:

- Additional Equity Rounds

- Lines of Credit (your business may qualify if you have a demonstrated high recurring revenue business model for at least six months, or certain capital groups may extend a line of credit against your receivables.)

- Going Public / IPO (Initial Public Offering)

Here is a table that summarizes the appropriate type of capital based on your:

- business model

- business stage

- founder’s capital

This can help you avoid Samantha’s mistake – wink-wink! 🙂

Want to get prepared to raise capital successfully?

Download our Free Fundraising Checklist Here: https://thechangeagenthub.net/fundraising-checklist

Once you receive the checklist you’ll be redirected to a video walkthrough so you can use this checklist most effectively. And you’ll also be invited to check out our 9-step fundraising preparation roadmap with detailed information called Impact Incubator Immersion. This program is the exact process all our impact clients have used to raise capital successfully.